“Financial inclusion is not poverty relief.”

“Target poverty alleviation could not be accomplished without financial inclusion.”

“Financial inclusion should be a major driving force behind poverty alleviation.”

A general consensus has yet to be reached on the relation between poverty alleviation and financial inclusion. Can financial inclusion make genuine contributions to poverty alleviation? How many viable poverty alleviation models are there associated with financial inclusion?

Financial Inclusion Holds the Key to Genuine Poverty Alleviation

Financial inclusion is intended to extend financial services to those unbanked and underbanked, including part of the impoverished population.

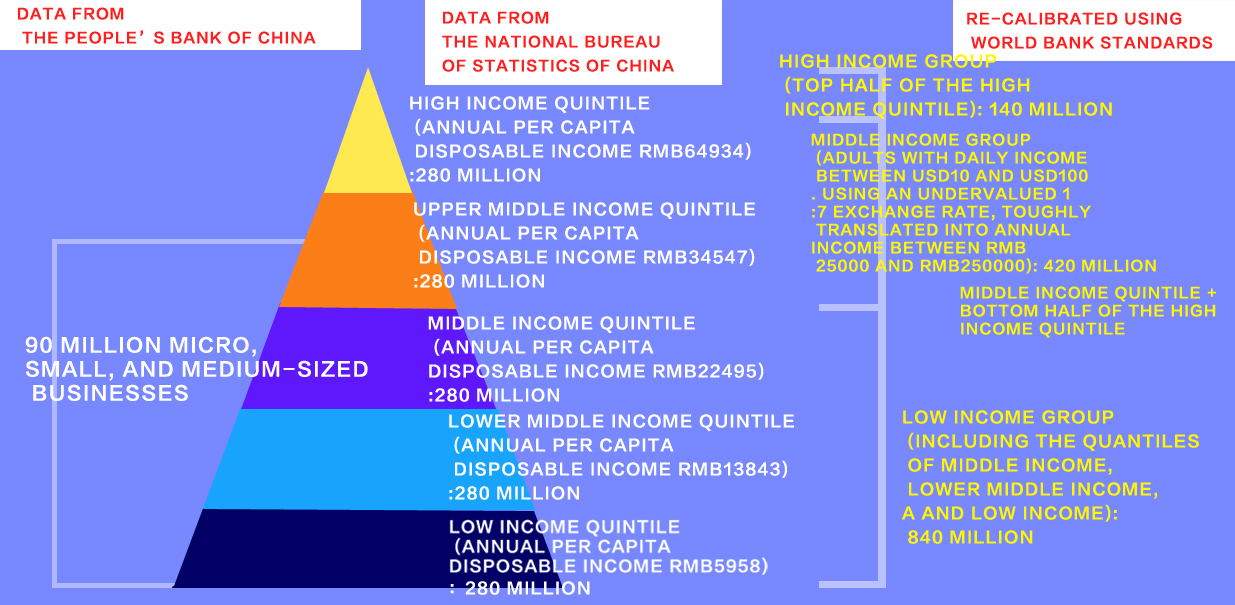

Figure1:Population Pyramid of China’s Micro, Small, Medium-Sized, and Other Vulnerable Groups[1],

As shown in the chart above, population below the national poverty line fall within National Bureau of Statistics' Low-Income Quintile. The 2017 per capita annual disposable income of this quintile is RMB5958, higher than the national poverty line set in 2016 of RMB3000. In its official communique titled Nationwide, Impoverished Rural Population Significantly Decreased, and the Growth of Household Income in Impoverished Rural Areas Accelerated in 2017, published on February 1, 2018, the National Bureau of Statistics discloses that by the end of 2017, rural impoverish population numbers at 30.46 million individuals.

In its 2017 China Systematic Country Diagnostic report, World Bank suggests that should higher international poverty line of USD3.1 of living expense a day[3], based on World Bank's International Comparison Program (ICP) purchasing power parity, rather than the absolute poverty threshold[2], be applied, all the 280 million individuals within the National Bureau of Statistics' 2017 Low-Income Quintile would be below poverty line. However, the World Bank report also suggests that even if the higher international poverty threshold were to be applied, impoverished population in China would be expected to drop to 54.60 million in 2018.

From a theoretical perspective, all the people living in poverty are the target segment that financial inclusion is to serve. From a practical perspective, however, given that financial inclusion has to serve the dual mandate of financial performance and social impact and its services are not for free, a finer segmentation of impoverished population is warranted.

Poor people's demands for financial services are varied:

l Entry-level financial services such as saving, payment, and transfer are to satisfy the most basic financial services needs of the majority of the impoverished population;

l Business and consumer financial services, particularly lending, are to meet poor people's needs for access to capital, lowering of production cost, improvement of efficiency, consumption smoothing, and enhancement of their financial standing, all arising from their productive and consuming activities amid their combats against poverty;

l Financial safety nets, especially insurance policies, serve to help poor people avoid and mitigate risks and losses when they encounter uncertainties in their productive activities and daily life; and

l Income-generating financial services such as wealth management are desirable for impoverished population and those newly escaping economic straits to increase household income and further improve their production quality and living standard.

All in all, it is safe to say that inclusive finance satisfies poor people's genuine needs for financial services amid their struggles against poverty, and therefore, such services are genuine poverty alleviation endeavors.

Financial Inclusion-Based Poverty Alleviation Models

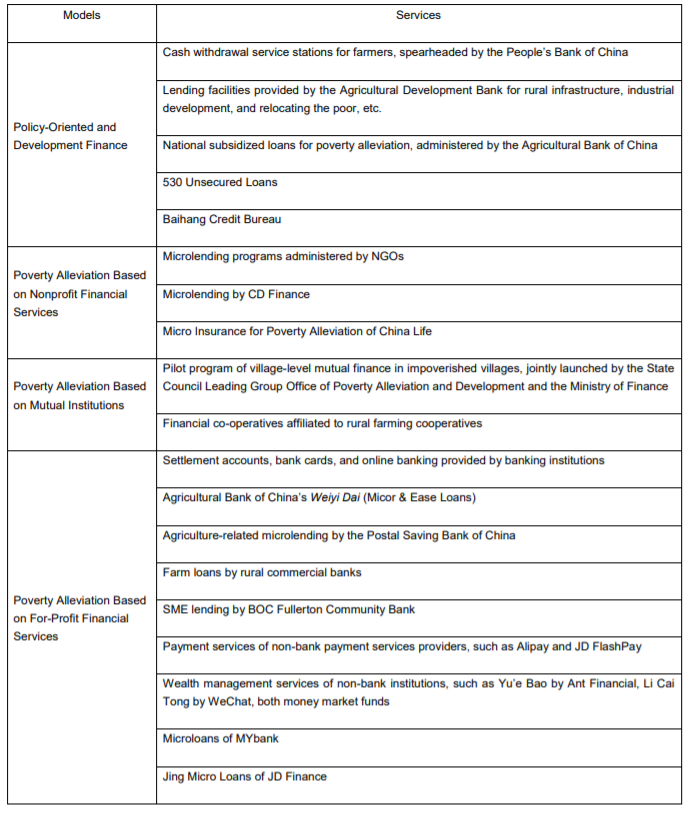

Responding to the national strategic imperatives of financial inclusion and target poverty alleviation, legacy financial institutions, emerging rural financial institutions, and internet finance firms are all committed to inclusive finance and poverty relief causes in earnest, striving to satisfy poor people's financial service needs via a cornucopia of offerings. As shown in the table below, policy-oriented financial institutions, a notable example being the Agricultural Development Bank of China, play an active role in implementing the national policy and strategic initiatives, fostering the development of agriculture, farming households, and rural communities, and providing financial supports to impoverished areas. Major commercial banks, such as Agricultural Bank of China and Postal Saving Bank of China are enthusiastic in financing agricultural and agribusiness sectors, rural infrastructure, and leading agribusiness companies; rural credit co-operatives are deeply rooted in and serving rural communities; village and township banks, among other emerging rural financial institutions, target at niche markets of rural and SME finance; microcredit companies focus on fractional and fragmented needs, and internet companies such as Ant Financial, JD Finance, and Meituan Financial Service include, via supply chain fiancé and industry chain finance, small merchants, consumers, and lower and lower-middle income farmers into their services.

Apparently, various types of financial institutions adopt varied approaches towards poverty relief with diversified institutional functions, target segments, extents of their services, poverty reducing effects, financial performances, and social impacts.

Poverty alleviation model based on policy-oriented and development finance put their emphases on implementing national policy and strategic agendas and their service offerings in impoverished areas usually have laser foci, examples including cash withdrawal service stations for farmers spearheaded by the People's Bank of China, lending facilities for relocating the poor by the Agricultural Development Bank of China, and national subsidized loans for poverty alleviation administered by the Agricultural Bank of China.

Nonprofit financial services mostly include microlending and micro insurance, such as CD Finance's microloans and micro insurance of China Life.

Poverty alleviation through mutual finance include both proof-of-concept process of new usage and administration mechanisms of fiscal funds for poverty alleviation, such as the pilot program of village-level mutual finance in impoverished villages, jointly launched by the State Council Leading Group Office of Poverty Alleviation and Development and the Ministry of Finance, and impoverished farmers' self-starting experiment of capital accumulation and mutual help mechanisms, such as the financial co-operatives affiliated to rural farming cooperatives.

Poverty alleviation through for-profit finance emphasizes the commercial sustainability of financial products and services and most of the commercial financial institutions adopt this approach.

Table 1: Financial Inclusion-Based Poverty Alleviation Models

[1] Statistical Communique of the People's Republic of China on the 2017 National Economic and Social Development: Divide the country's residents into five quintiles by disposable income, and annual per capita disposable income of low-income group is RMB5958, lower-middle income RMB13843, middle income RMB22495, upper middle income RMB34547, and high income RMB64934.

Yi, Gang: By the end of 2017, there are 28 million micro and small business entities and 62 million individual business operators, combined accounting for over 90% of all business entities in China.

[2] The higher international poverty line singles out those living in medium-level poverty or those susceptible to returning to poverty, roughly translated to annual income of RMB7920, based on a 1:7 USD/RMB exchange rate.

[3] The global extreme poverty threshold in USD1.90 a day, roughly translated to annual income of RMB4855, based on a 1:7 USD/RMB exchange rate.

THE END